Academic research shows whenever a stock’s price has been increasing over the past six to twelve months, it is likely to continue to increase over the next six to twelve months. Similarly, whenever a stock’s price has been declining over the past six to twelve months, it is likely to continue to decline over the next six to twelve months.

We can calculate this propensity to increase as price momentum and compare it to all the other stocks in the Index. This generates our rankings with the highest price momentum being in position 1, and the least price momentum being in position 100.

We call this ranking, the Zone Changes report.

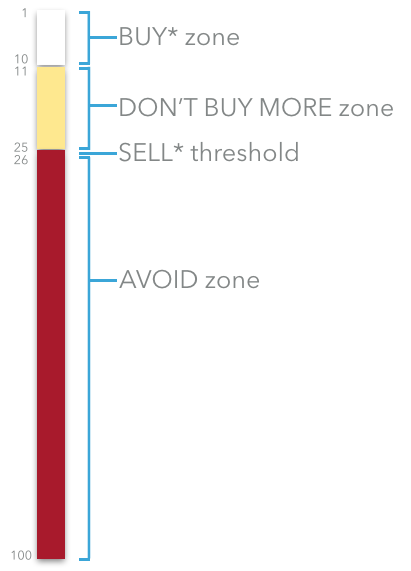

This report is further subdivided for action into three zones: the Buy Zone – stocks ranked 1 – 10, the Don’t Buy More Zone – stocks ranked 11 – 25, and the Avoid Zone – stocks ranked 26 – 100.

Stocks in the Buy Zone are the likely best price performing stocks in the listing. Users should buy them. Over time, these stocks will move about the rankings and whenever they move into the Avoid Zone, they should be sold.

They’re still fine companies, and may be back in the Buy Zone in no time, but with the best information available at the date and time of the Zone Changes report, there are 25 (or more) higher ranked opportunities deserving (we think) of investment.