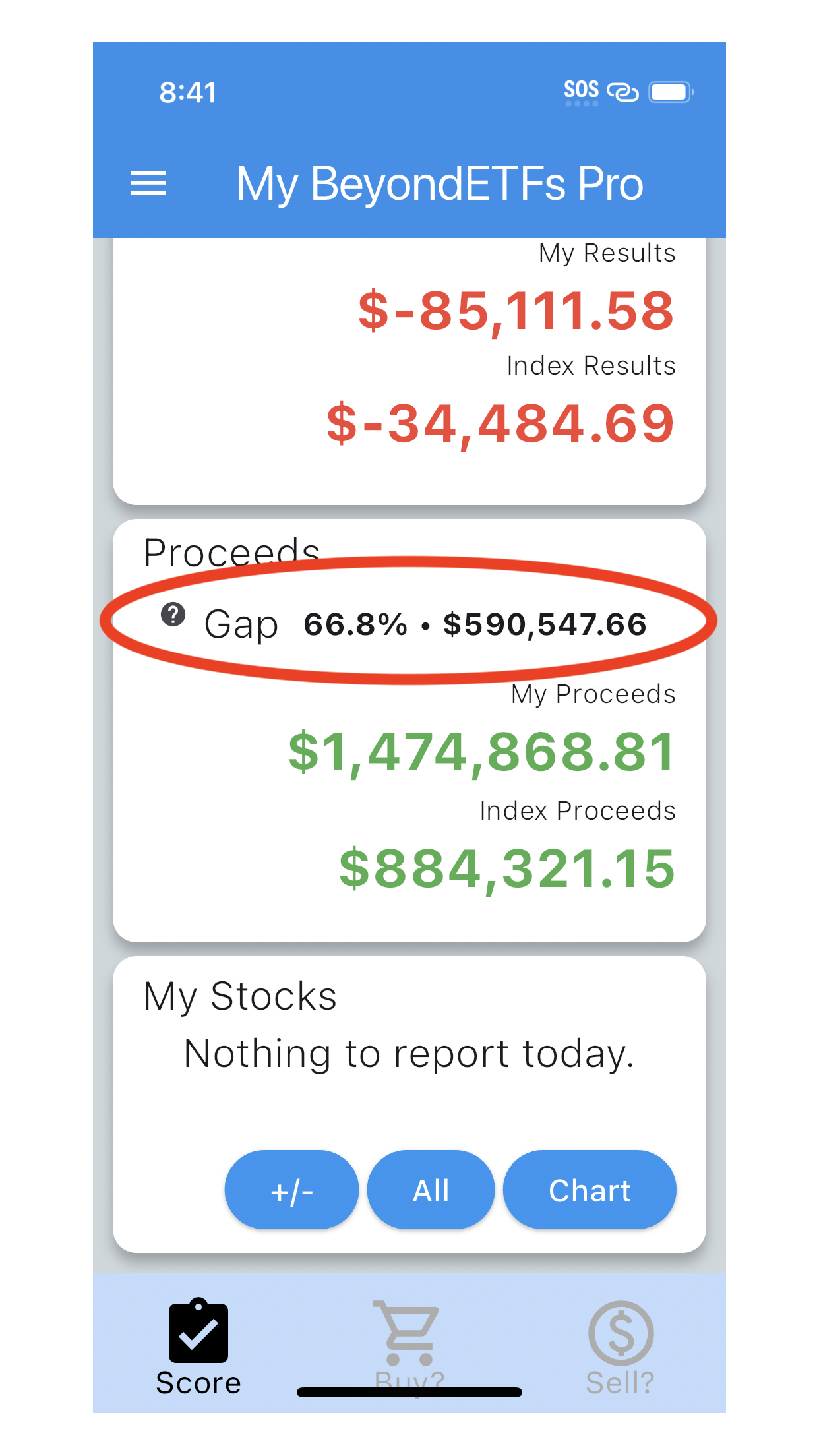

On the Scorecard view of the BeyondETFs Pro default view, is a little label ‘Gap’ with some % and $ value next to it.

At the moment of recorded purchase, an equivalent $ value and quantity of Index was also noted.

Gap refers to the difference between what your actual proceeds are compared to what they might have been if you had purchased the Index at that time. The Gap % is relative to the Index as ((Proceeds – Index Proceeds) / Index Proceeds x 100).

In this case, the user has earned 66.8% more and $590,547.66 more than if they had purchased the Index.

So, the Gap metric constantly changes. It is the sum of the interval between each stock’s instantaneous value and the instantaneous value of the initial equivalent Index quantity recorded at the moment of stock purchase.

It’s a measure of how well your portfolio is beating the Index and how much better off you are instead of purchasing the Index.