Years ago, in business school, my professor talked about an important marketing principle: Worth What Paid For. The idea is to question ‘is that product or service worth what the customer paid for it?’

You can break down the actual costs of service or production and then look to the perceptions to account for any ‘extra price’ above the cost associated with the target product or service. Knowing the source of that perceived value is important to understand. Let’s begin to check out the investment products and their worth what paid for.

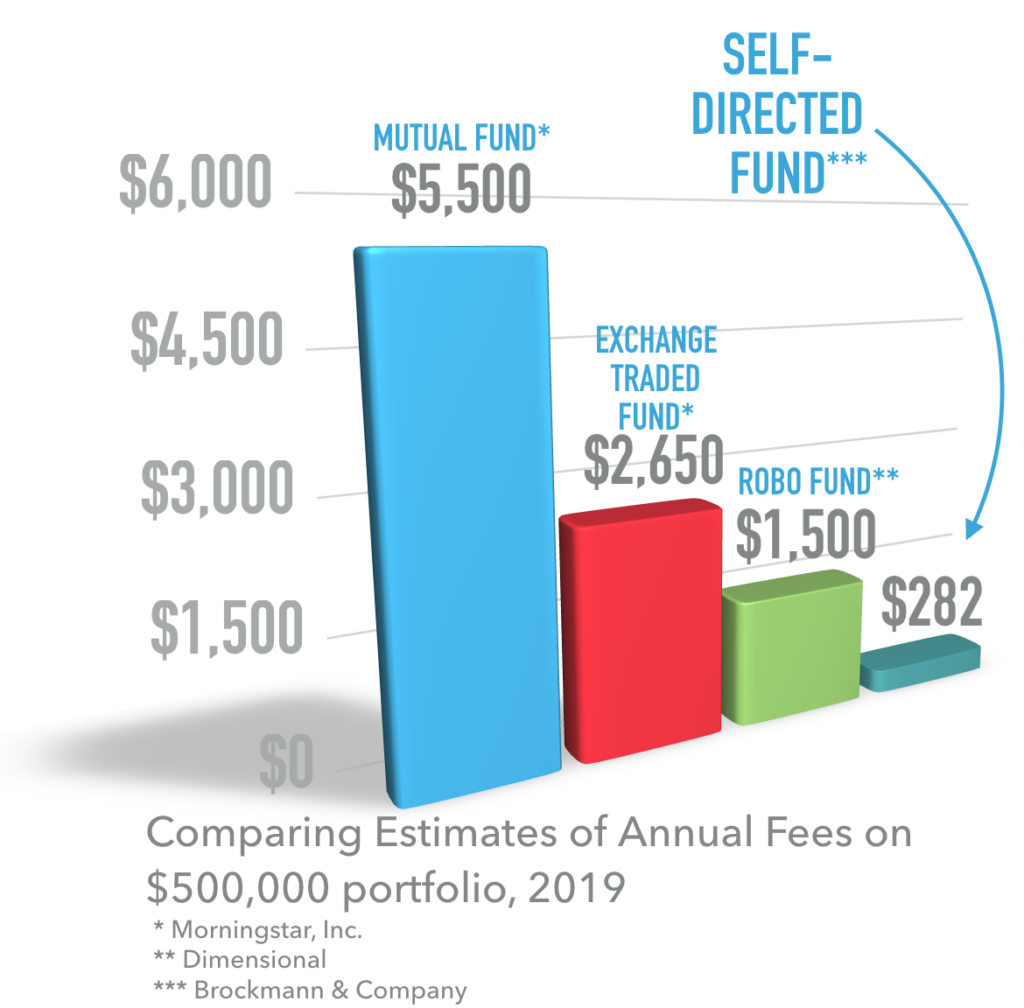

In a recent Wall Street Journal article, a leader in the emerging category of ‘robo-funds’, Dimensional Fund Advisors, compares their typical fees with Morningstar Inc’s calculation of the average Mutual Fund and Exchange Traded Fund annual fee.

In this graphic, we compare those fees with our estimate of the typical Self-Directed Fund cost of ownership for a portfolio valued at $500,000, with an average of 27 trades at $6/trade and an annual research subscription fee of approximately $120/year. Note that today, that $6/trade in many markets around the world is either zero or pennies. In that case the price of the Self-Directed Fund falls more than half to $120/year.